考试题型

Section A 单选题 2’*15

Section B 综合单选题 10'(每题5道选择)*3

Section C 综合计算题 20' * 2

核心练习真题 ,小编再送一个考试资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

DEC 14 - Mar/Jun 16

Specimen paper 2016

Specimen paper 2014

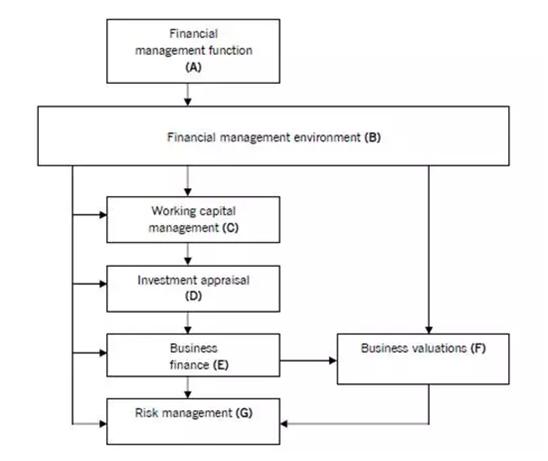

Part A Financial management function

Part B Financial management environment

考试分布

Section A 单选题 4-6道

考点类型

基本概念,注意理解,运用到scenario question;

ratio 小计算(TSR)

复习计划

Exam Kit &历年真题:选择题(Section A)

考点总结

1.讨论Financialmanagement & objective

Objectives :maximization of shareholder wealth VS accounting profit

计算能够反映盈利能力和对股东财富的影响的ratio

常见Ratio

1)Shareholder wealth

TSR

DPS, Dividend yield

EPS, P/E ratio

2)Financial performance:profitability

ROCE

ROE

2. 激励高管实现股东财富最大化的目标

a) Managerial reward schemes:

Performance-related bonus, share,shareoption

b) corporate governance

c) stock exchange market rule

3. Objective setting in not forprofitorganizations非盈利机构指标

value for money(Economy,Efficiency,Effetiveness)

1)财政政策Fiscal policy VS 货币政策monetary policy

Fiscal policyVSMonetary policy

TaxationInterest rate

Government expenditure (budget, government borrowing)Money supply

2)宏观经济目标Macroeconomicpolicy & targets:

3)政府干预competitionpolicy;government assistance;green policies;corporate governanceregulation

4. 货币市场money VS 资本市场capitalmarkets

i) Role of financial intermediaries金融中介作用

ii) principal money market instruments主要的货币市场工具

Part C Working capitalmanagement

考试分布

Section A 单选题 3-4道 or Section A 单选题 2道

Section B 综合单选题 10分

Section C 综合计算题 20分

考点类型

文字理论WC management,inventory,receivables, payables, cash管理工具计算

复习计划

Exam Kit &历年真题:选择题 &计算题

考点总结

1.objectivesof WC management

i) WC investment policy: aggressive/conservative

ii) central role of WC managment infinancialmanagement

iii) Factors determine the level ofworkingcapital investment

结合行业特征,公司working capital管理策略及operatingcycle

iv) working capital financing policy 融资策略

a)permanent andfluctuatingworking capital

b)Aggressive, Conservative,Matching

2.Inventory management 存货管理

i)计算 EOQ & 讨论EOQassumption, disadvantage

ii) 计算Whether take Bulkpurchase discount:cost vs benefit

iii)计算Inventory level:buffer inventory/re-order level/averageinventory

iv) 讨论Just-in-time

3.Receivablesmanagement应收账款管理

i)Calculate and discuss of offeringcashdiscount

ii)Calculate and discuss of factorservice:recourse VS non-recource

思考角度:cost VS benefit

iii) Factor considering to formulatereceivablepolicy 以及应收账款管理3个流程

Credit analysis system, Creditcontrolsystem,Debt collectionsystem

4.Cash management

i) cash balance status and investingchoice

ii) cash budget & forcast

iii) Baumol model and the Miller-Orr model

5.Cash operating cycle

i) 计算ratio:Inventorydays, receivable days,payable days, operating cycle

Ratio analysis: current ratio, sales/networkingcapital,

(ii) Cash flow budget

(iii) Overtrading and overcapitalization

Part D Investment appraisal

考试分布

Section A 单选题 2-3道

Section C 综合计算题 20分

复习计划

Exam Kit&历年真题:选择题&大题计算题

考点总结

1.Investment appraisal methods

各种方法优缺点

i) ROCE: accouting profit

ii) Payback period

iii) IRR

iv)核心计算考点NPV:注意inflation,relevantcashflow,working capital ,Timing for tax relief

2.Risk & uncertainty

i) Difference between risk and uncertainty 文字理解

ii) EV计算 &优缺点

iii)Sensitivity analysis计算优缺点

3.Speical investment decision

i)Lease or buy

分析 Cost VS benefit, consider relevant cashflow

ii) Asset replacement

iii) Capital rationing

解释divisible VSnon-divisible project

解释soft VShard capital rationing

计算profitability index

Part E Business Finance

考试分布

Section A 单选题 2-3道

Section C 综合计算题 20分

考试核心知识点

source of finance & costof financeWACC(Ke/Kd) 计算

复习计划

Exam Kit &历年真题:选择题&计算题

1.Source of finance

常见文字题:Factors considering to choose finance(Debt & Equity)

计算ratio,评估公司现在的财务状态,选择最佳的融资方式

Debt finance和equity finance的选择对股东财富,资本结构,财务风险的影响

结合EPS,Share price,gearing, interest cover等ratio

不同融资类型的方式和特点Short-term VS long-term

(1) Short-term finance

--overdraft

--short-term loan(bank loan)

--trade payable (interest-free finance VSloss of cashdiscount)

--lease(operating lease)

(2) long-termfinance

1)Debt finance 债务融资

2)Equity Finance

常见对Right issue计算讨论,注意 TERP与 issue cost

3)Venture Capital

4)Islamic finance 名词代表的含义

5)Dividend policy 掌握主要theory以及制定policy时需要考虑的因素

i)Residue theory

ii) Traditional theory

iii) Irrelevant theory

iv) other type of dividend

6)Finance for SMEs (Article:Businessfinance for SMEs )

关注Crowdfunding/supplychain finance)

2.Costof capital

1) WACC

i)Ke

DGM: ke= Do*(1+g)/P0+ g g = historicalgrowth or g = br

DGM model缺陷

CAPM: Ke = Rf+ β*(Rm- Rf)

CAPM优缺点

Systematic risk & Unsystematic risk

ii) Kd (after-tax)

Irredeemable debt: Kd(after-tax) =I*(1-T)/P0

Redeemable debt & convertible loan note:IRR

preference shares: Kp = D/P0

2)project spcific Ke (adjustedrisk Ke)

Ungeaing, regearing, CAPM, risk adjustedWACC

文字描述Adjusted Ke的过程&缺陷

WACC何时适用于新项目NPV评估

3)Capital structure theory

Tranditional theory

MM with tax &without tax

Pecking order theory

Part F Business Valuation

考试分布 小编再送一个考试资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

Section A 单选题 2-3道

Section B 综合单选题 10分

考试形式

计算部分:Valuation of Co.

文字题:估值方法优缺点;Market efficiency理论

考试核心知识点

1.Business Valuation

掌握主要估值方式以及各种方法优缺点

1)Valuation for Equity

a. Asset based

Historical basis

Replacement value

Realizable value

b. Earnings base

P/E ratio Earningyield

c.Cash flow based

- DVM/DGM

- Discounted CF

2)Valuation for Debt

- Irredeemable debt

- Redeemable debt

- Convertible debt

- Preference share

2.EMH

选择题中常以case出现,什么样的市场反应什么样的信息

什么样的投资方法能够帮我们获益(abnormal return)

Weak form

Semi-strong

Strong

Part G Risk management

考试分布

Section A 单选题 3-4道

Section B 综合单选题 10分

考试形式

文字题:基本概念,掌握成因理论及主要的风险规避工具

计算题:IRPT,PPPT,forward contract & money market hedge

1.foreignexchange risk

1)types pf risk

-- transaction risk

-- translation risk

-- economic risk

2)cause of change

four-way equivalence

-- PPPT: inflation rate VS futurespotrate--< S1 = S0*(1+hc)/(1+hb)

-- IRPT:interest rate VS forwardrate--< Fo= S0*(1+ic)/(1+ib)

-- expectation theory

-- internation Fisher effect

3)hedge tools

internal methods 掌握原理特征

-invoice in home currency

- matching:foreign currency receipt &payment

- netting:net risk expose -- savetransactioncost

- leading & lagging:(payment in advanceordelay) flexible settlement date

external methods

计算+原理+优缺点

- forward exchange contract

- Money market hedge

原理+优缺点

- future contract: standarized contract tobuy orsell specified quantity

- option:a right to buy orsell foreign currency futures

- swaps:

2.interestrisk

1) Risk

-- Gap exposure

interest movement is adverse toCo.

interest -sentitive liability< interest- sensitive asset ==

-- Basis risk

2)cause of movement

- yield curve

liquidity preference theory

Expection theory

Market segementation theory

3)hedge tools 原理+优缺点

internal

- matching : asset & liability withcommoninterest rate

- smoothing: balance of fixed rate&floating rate

- Asset & liabilitymanagement:matching duration of interest of asset & liability

external

- forward rate agreement: fixedinterestrate

- IRG: option on FRA

- interest rate future

- options on interest future

- swaps : exchange fixed rate orfloatingrate

-

2018-04-11

-

2018-06-01

-

2017-06-12

-

2018-03-01

-

2018-04-12

-

2018-04-19